Dalian Wanda Group Co., one of China’s largest private conglomerates, is set to face its biggest bond-repayment test since its dollar notes’ recent plunge to distressed levels.

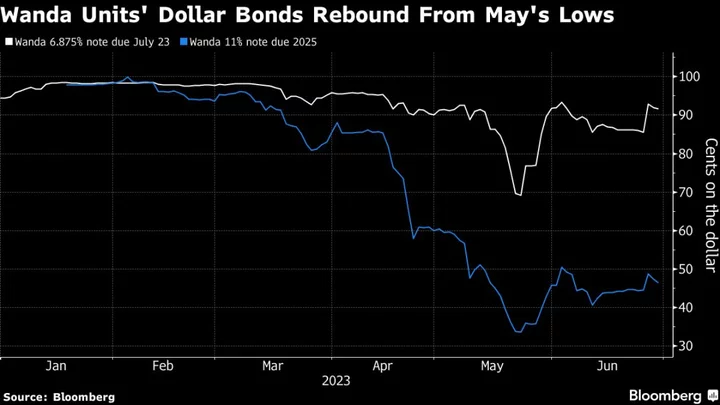

The group has a $400 million bond coming due July 23, at a time when the halt of a unit’s debt-issuance application could revive liquidity concerns. The note now trades above 90 cents on the dollar after climbing from last month’s low of 69 cents, a level that reflected diminished expectations for full repayment.

Investor sentiment has been on a roller-coaster ride, and that continued this week. Wanda notes jumped on a large bad-debt manager’s move to take over a joint venture and the conglomerate being said to have readied cash for a loan repayment. But optimism cooled after China’s top securities regulator agreed to a Wanda unit’s request to suspend the bond-sale application.

Key to the group’s future debt financing efforts is its fourth attempt to list a shopping-mall unit in Hong Kong, an initial public offering that’s under regulatory review and said to be the reason behind the frozen local-note issuance plan. If the share float fails again, Wanda may also have to pay about 30 billion yuan ($4.1 billion) to investors of the unit.

What’s the company?

Founded in 1988 by billionaire Wang Jianlin, Wanda over the years amassed assets ranging from the Ironman triathlon business to at one time being the world’s biggest cinema operator through its purchase of US-based AMC Entertainment Holdings Inc. Wang once had hopes of turning his group into China’s answer to Walt Disney Co.

Wanda’s course changed after the country’s stock-market bubble burst in 2015 and the government moved to tamp down on the global ambitions of some Chinese firms. Divestitures followed, including hotel and theme-park assets. Wanda’s main business in recent years has been commercial property. The group manages more than 400 malls.

What’s happening?

Concerns emerged in April as the third application to list Zhuhai Wanda Commercial Management Group Co. in Hong Kong lapsed. Its IPO has been watched because of the potential equity repurchase by the conglomerate if there’s no listing by the end of 2023.

Some big global money managers including Deutsche Bank AG and Fidelity International Ltd. bought Wanda dollar notes as debt worries mushroomed the past several months, a period of surging volatility for the notes. Prices dropped amid the IPO worries and after the group disclosed plans to downsize. There’s also been several notable rallies — such as in late May when Wanda said no lenders had sought early repayment on offshore loans.

Wang has been negotiating with regulators and strategic investors on potential support amid efforts to save Wanda, according to people familiar with the matter. Lieutenants have crisscrossed the country to push for debt extensions. Potential sales of various assets are under consideration.

Why does it matter?

Worries about Wanda fueled a 10% loss in China’s junk dollar-bond market between mid-April and late May’s bottom, according to a Bloomberg index. As defaults surged to records last year amid the property sector’s liquidity crunch, the group has been a bellwether among noninvestment-grade firms — applauded for its efforts to slim down following last decade’s acquisition binge.

A Wanda unit is among the country’s few junk-rated offshore bond issuers this year. But both of its notes sit below 50 cents on the dollar, a plunge Bloomberg Intelligence analyst Dan Wang said has broadly hurt high-yield issuance from Chinese borrowers.

What does the company say?

Wang, Wanda’s founder, acknowledged some difficulties at the group during an April management gathering, Bloomberg reported at the time. But he also said the conglomerate can overcome its challenges, including the mall unit’s delayed IPO.

Wanda last month denied reports of mass layoffs, but did tell Bloomberg it plans to downsize some units in a move that won’t result in large-scale job cuts. Days later, the group said it was “untrue” that it would sell 20 malls for 16 billion yuan. After a Shanghai court in early June froze a 1.98 billion yuan stake in key unit Dalian Wanda Commercial Management Group Co., Wanda said it would protect its rights through legal action.

Wanda didn’t respond to a request for comment.

What do the ratings firms say?

All three major global ratings firms have dropped Wanda Commercial deeper into junk territory since Zhuhai Wanda’s IPO filing lapsed in April. They also have Wanda Commercial on review for a possible further downgrade in light of liquidity concerns.

Fitch Ratings flagged the group looking to extend short-term bank loans and uncertainty related to the IPO, including whether Zhuhai Wanda investors will agree to extend this year’s listing deadline. Moody’s Investors Service highlighted potential contagion risk exposure to Dalian Wanda and S&P Global Ratings among other things cited soft property sales at Wanda Properties Group Co.

What are traders watching for next?

There’s lots to monitor, but at the top of the list is debt payments. Bond obligations alone could top $1 billion the rest of this year for the group. Progress on loan extensions and asset sales are also key.

The fate of Zhuhai Wanda’s latest IPO application in Hong Kong remains a potential game changer. China’s securities regulator, which requires mainland companies to register a planned overseas listing with it, earlier this month asked the firm for more information.

--With assistance from Shuiyu Jing and Emma Dong.