A world economy struggling with record debt, expensive credit and increasingly dysfunctional or inadequate institutions now faces new dangers from war in the Middle East, adding a significant risk atop an already fragile outlook.

The fighting between Israel and Hamas hung over a marathon week of meetings among the financial and policy elite in Marrakech, Morocco led by the International Monetary Fund and World Bank. The conflict overshadowed their calls for fresh climate funding and debt relief for poor nations, an effort already challenged by political dysfunction in richer countries and US-China competition.

“We are living in a world with alarming challenges but at a time of intensifying polarization and extremes,” World Bank President Ajay Banga said Friday, acknowledging “understandable” frustration in the Global South. “They’re concerned promised resources will never manifest, they feel energy rules aren’t applied universally, and they’re worried a burgeoning generation will be locked into a prison of poverty.”

Here’s a look at the key themes of the week:

War

The surprise Oct. 7 attack on Israel by Hamas militants meant the latest Middle Eastern War was destined to dominate discussions. Through the early part of the week, with the scale of the conflict unclear and the market reaction relatively muted, there was a sense that perhaps the world economy would escape major damage.

“We’re monitoring potential economic impacts from the crisis, but I’m not really thinking of that as a major likely driver of the global economic outlook,” US Treasury Secretary Janet Yellen said Wednesday.

As the meetings continued, Israel’s call for an evacuation of civilians in Gaza city, the threat of a possible new front in the north and protests flaring in the region added to concerns it would broaden and the economic fallout worsen. French Finance Minister Bruno Le Maire told reporters that “geopolitical risks are the most significant risk for the world economy now,” a sentiment that grew as the days ticked by.

Yet when it came time for the world’s top finance officials to issue their consensus communique on the global outlook, there was no direct mention of the Israel-Hamas War — the very event that had so dominated the narrative.

It’s just the latest illustration of how the Group of 20, which bills itself as the “the premier forum for international economic cooperation” is struggling for relevancy in a fragmenting world. The Group of Seven, representing the richest nations, was full-throated in its support of Israel, a contrast that reflects an underlying tension between between the so-called Global North and South.

- Wider War in Middle East Could Tip World Economy Into Recession

- Talk of War Dominates Annual Gathering of Global Finance Chiefs

- G-7 Condemns Hamas Attack and Pledges Solidarity With Israel

Debt

There was some incremental progress on debt relief — and a bit of a stumble when it came to the communications.

IMF Managing Director Kristalina Georgieva on Thursday said an accord between Zambia and its official creditors, co-led by China and France, had been signed. Moments later, officials had to clarify that the agreement was close, not inked. Meanwhile, an expected separate deal with Sri Lanka’s official creditors never materialized.

In a Bloomberg Television interview, Georgieva called for an acceleration in the deal making progress to help poorer nations in debt distress get help quicker. She said the global sovereign debt roundtable forum, which she helped create at the start of the year, is helping shorten the time needed to get get deals done and unlock new funds.

- IMF Talks on Debt Deadlock Stuck Between China, Private Lenders

- IMF Bungles Zambia Deal Announcement by Front-Running Accord

- Sri Lanka Urges China to Share Debt Terms to Help Other Deals

Funds

When Africa last played host to the IMF and World Bank’s annual meetings in 1973, then Bank President Robert McNamara urged rich nations to show more generosity toward the poor. Some 50 years on, Banga, the current president, is still urging.

In a speech Friday, Banga asked the lender’s members to make record contributions in the next funding round for its arm that helps the 75 poorest nations, warning of declining progress in the fight against poverty.

The Biden administration has requested $2.25 billion for funding from Congress, a portion of which Treasury officials say could help “unlock” up to $25 billion in additional lending. And if other rich countries follow suit, the total effort, including private capital, could reach more than $100 billion.

Even if that comes together, it won’t match what’s needed. An influential report co-lead by former US Treasury Secretary Lawrence Summers sees $500 billion needed from international development lenders to help reach the extra $3 trillion required per year by 2030 for developing countries.

Meanwhile, the IMF announced it closed the $3 billion funding gap to subsidize its Poverty Reduction and Growth Trust, allowing it can lend to the neediest countries at zero-interest.

- Africa Finds ‘No Mercy’ From Global Cash Crunch It Didn’t Cause

- World Bank Head Seeks Record Help for Arm Aiding Poorest Nations

- Africa Is Front and Center at IMF as US-China Rivalry Heats Up

Rates

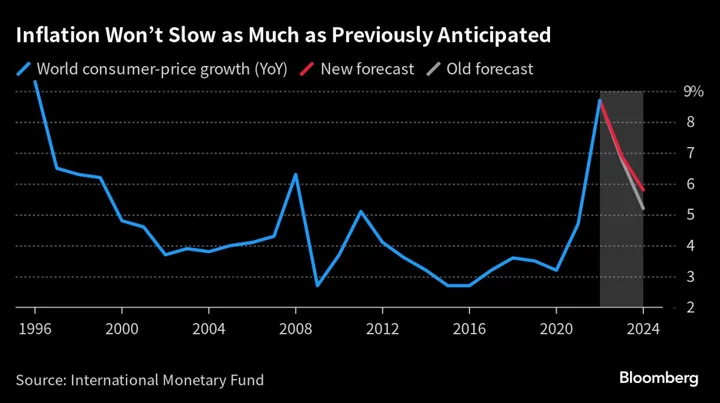

As officials met in Marrakech, traders were busy digesting the latest worrying readings on US inflation. Even against a backdrop of weakening global economic growth, the IMF called for central banks to keep policy tight until there’s a durable easing in global price pressures.

Yet attendees at the same time cautioned that the wholesale tightening also risks inflicting a shock to a world economy.

“Debt levels are at record high levels at the same time that we’re in this higher-for-longer interest-rate environment,” Gita Gopinath, the No. 2 official at the IMF, told a panel hosted by Bloomberg’s Tom Keene.

“Higher for longer is also harder for longer for emerging markets,” Joyce Chang, JPMorgan Chase & Co.’s global research chair, said on the panel.

Then there’s the risk that a broadening of the conflict in the Middle East send oil prices racing higher, setting back the effort to wrestle inflation toward central banks’ target zones.

- Higher-for-Longer Rates Worry World Bank as Debt Ripples Spread

- IMF Warns of Stubborn Inflation, Weak Global Growth in 2024

- Fed’s Bowman Says Higher Rates May Be Needed to Curb Inflation

Reform

The International Monetary Fund’s top policy committee agreed Saturday to update its voting shares in the future to better reflect the economic heft of its members. But it’s not quite as simple as just announcing that intention.

The effort sets the US, the IMF’s most-powerful voice, at odds with China and other emerging economies who are seeking larger shares. Any change in voting would need approval from US Congress, which is loathe to advance policies that increase the influence of its geopolitical rival China.

Countries like Brazil, whose economies have grown significantly faster than those of developed nations, have long called for a re-division of quotas to reflect their heavier global economic heft. China, for example, accounts for about 18% of global output but holds just a 6% vote at the IMF, compared with Washington’s 17% vote.

“If we were going to do that, I think we would have to feel as if they were good, solid members of the IMF, living up to the obligations all of us have,” said Yellen, referring to China and its perceived unwillingness to cooperate with the IMF, particularly around debt relief.

Brazil Finance Minister Fernando Haddad said on Friday that he made clear to the IMF’s Georgieva that while he understands the political reality in the US, failing to eventually update IMF voting shares would weaken the organization in the medium and long term.

As for changing the voting share, the committee said the IMF executive board should develop by June 2025 “possible approaches as a guide for further quota realignment, including through a new quota formula.”

- IMF Stymied Again by War With No Communique After Marathon Talks

- China Must Play by Rules to Get More IMF Sway, Villeroy Says

- Yellen Resists Pressure for Reform of IMF Voting Shares

--With assistance from Abeer Abu Omar, Alister Bull, Christopher Condon, Craig Stirling, Ekow Dontoh, Heng Xie, Jan-Henrik Förster, Jana Randow, Kamil Kowalcze, Katherine Griffiths, Martha Beck, Michael Gunn, Mirette Magdy, Philip Aldrick, Souhail Karam, Toru Fujioka and Yujing Liu.