Japan’s impressive stock rally may cool in the second half of this year as the highly cyclical market is susceptible to an expected global economic slowdown, according to Melbourne-based Talaria Capital.

The world’s third-largest share market will likely end 2023 lower from current levels, as aggressive monetary tightening by major central banks finally causes global growth to weaken, hurting Japanese exporters, said Hugh Selby-Smith, the money manager’s co-chief investment officer. The benchmark Topix index has rallied 20% this year, after hitting the highest level since July 1990 earlier this month.

The A$1.5 billion ($1 billion) Talaria Global Equity Fund, which has no exposure to Australian shares and started the year with 17% invested in Japanese equities, is up 8.4% this year, versus a gain of 1.6% in the MSCI World ex-Australia Value Net Total Return USD Index that the fund uses as a guide. About a third of the fund’s growth has come from Japanese holdings, he said.

The fund has exited its position in Asahi Group Holdings Ltd., as the brewing company has reached its fair valuation after a strong rally, said Selby-Smith. The money manager, however, remains bullish on Japan over the next three to five years due to benefits from supply chain diversification to domestic corporate reforms, he said.

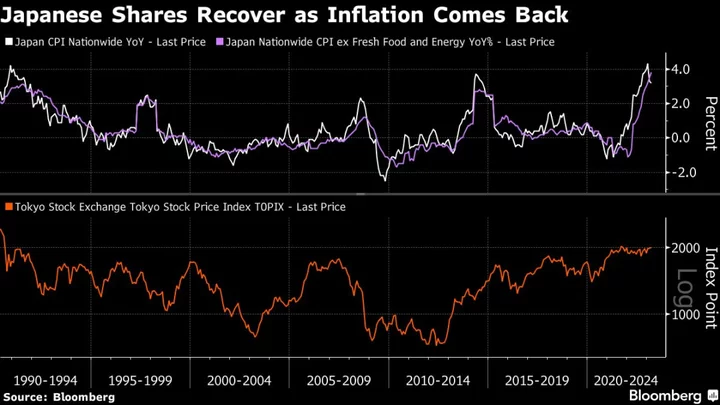

The Australian money manager’s cautious near- to medium-term outlook comes as Japan’s biggest share rally in 14 years faces speed bumps, with foreign investors recording negative flows for the first time in 11 weeks and selling pressure from quarter-end balancing by domestic pension funds. While strong earnings and corporate efforts to boost shareholder returns may continue to underpin the market, faster-than-expected inflation is rekindling concerns about the Bank of Japan tweaking its monetary stimulus program.

“If Japanese and global growth falters because of the lagged impact of monetary policy, and given Japan is one area where investors still have significant exposure to the global business cycle, then I think it’ll be lower,” said Selby-Smith.

Still, Japan will remain “a fertile hunting ground” for international investors to re-engage with in the next three to five years, unless the economy reverts to the deflationary trend and corporate growth slows, he said.

His fund continues to hold stocks including Nippon Telegraph & Telephone Corp., Secom Co. and Mitsubishi Electric Corp., Selby-Smith said.

--With assistance from Hideyuki Sano and Adam Haigh.