The South Korean won will probably maintain its lead as the best-performing Asian currency this quarter, keeping ahead of the Thai baht, according to analysts.

The won is benefiting from a rebound in exports, while an expected tourism recovery for Thailand hasn’t been as strong, according to Natwest Markets. Of the two central banks, both of which have their final policy meetings of the year this week, the Bank of Thailand may sound more dovish with inflation lower, said Standard Chartered Plc.

Asian currencies are recouping some of their earlier losses this year as expectations grow that the Federal Reserve is near the end of its hiking cycle. That’s reviving investor interest in emerging markets, with South Korea and India seeing inflows into their stocks and bonds.

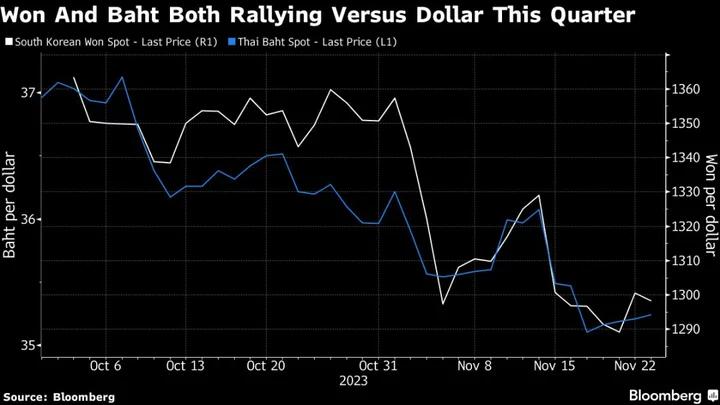

The won has gained 3.3% this quarter to 1,306.30 as of Friday, while the baht is up 2.6% at 35.485..

The Bank of Korea is likely to sound more hawkish after it flagged upside risks to inflation early this month, while the Bank of Thailand will probably reiterate its dovish stance amid slowing economic growth and easing price pressures, according to analysts.

“After headline inflation fell into the red in October, a potentially dovish-sounding BOT should be baht-negative, given already-wide rate differentials with the US,” said Nicholas Chia, a Singapore-based macro strategist at Standard Chartered. The BOK will be more relaxed over won strength, given still-salient inflationary pressures, he said.

While the Bank of Thailand is likely to leave its benchmark interest rate unchanged this week, the odds of a Thai rate cut next year have increased after Southeast Asia’s second-largest economy missed last quarter’s growth estimate, said analysts from Nomura Holdings Inc. and Standard Chartered. Inflation in Thailand fell in October for the first time in more than two years.

Besides the monetary policy seen favoring the won, rising exports are also supportive.

“The won has more going for it from a fundamental perspective, given that a gradually improving exports outlook can be more supportive in a more benign USD environment,” said Galvin Chia, emerging markets strategist at Natwest Markets in Singapore.

Here are the key Asian economic data due this week:

- Monday, Nov. 27: China industrial profits, Japan services PPI, Thailand customs trade balance

- Tuesday, Nov. 28: Australia retail sales, Taiwan 3Q GDP, South Korea consumer confidence

- Wednesday, Nov. 29: RBNZ rate decision, Bank of Thailand rate decision, Australia CPI and 3Q construction work done, BOJ’s Adachi speaks

- Thursday, Nov. 30: Bank of Korea rate decision and South Korea industrial production, China PMI’s, Australia house prices and 3Q private capex, New Zealand business confidence and house prices, Japan retail sales and industrial production, BOJ’s Nakamura speaks, Thailand trade balance, India 3Q GDP

- Friday, Dec. 1: South Korea trade data, China Caixin manufacturing PMI, New Zealand consumer confidence, Japan 3Q capital spending, Indonesia CPI