Expectations among US stock investors that the worst of pressures may have passed will likely be proven wrong as recession risk still looms, according to JPMorgan Chase & Co.’s Marko Kolanovic.

The strategist reiterated Monday that equities are set to weaken for the remainder of the year as the full impact of interest-rate hikes catches up to the economy and some factors supporting growth — such as strong corporate margins — wane.

The Federal Reserve raised its benchmark rate by another 25 basis points last week to the highest since 2007 — a move seen by several traders as the last hike of the current monetary tightening cycle. Market pricing suggests investors expect the US central bank will start cutting interest rates before the year is over.

“What equity and more broadly risk markets refuse to acknowledge is that if rate cuts happen this year, it will either be because of the onset of a recession or a significant crisis in financial markets,” Kolanovic wrote in a note to clients Monday.

Kolanovic was one of Wall Street’s biggest optimists throughout much of the stock market selloff in 2022, but has since reversed his view, cutting the equity allocation in in his bank’s model portfolio in mid-December, January and March due to a deteriorating economic outlook this year.

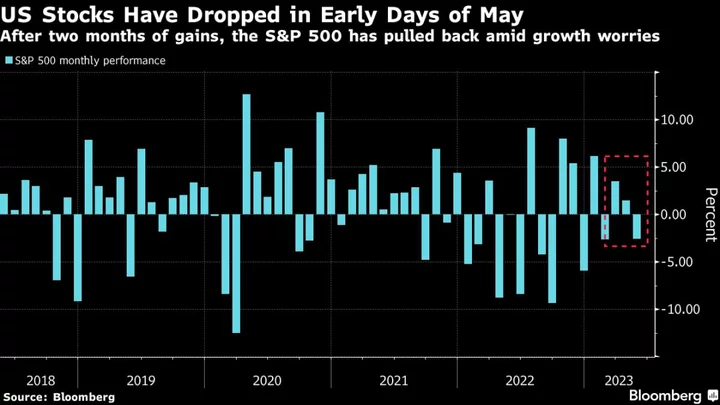

US stocks struggled for direction in subdued trading Monday as investors weighed the risk of a recession finally ending the Fed’s policy tightening.

JPMorgan said a historically low rotation into defensive pockets of the market compared to the end of prior economic cycles implies that the risk of a recession is far from priced in. The US banking crisis is also expected to amplify the cumulative impact of Fed tightening, according to Kolanovic.

“We never had a sustained rally before the Fed has even stopped hiking, nor before the recession started,” he said.

Other headwinds that investors face include a narrowing gap between the bond market, equity market, and the Federal Reserve, as well as the approaching deadline for the US to raise its debt ceiling.

Meanwhile, positive earnings surprises have not altered the bank’s view about slowing growth due to significant estimate cuts before the season began that significantly lowered the bar.

“Outside these hard to interpret surprises versus bottom up analysts forecasts, in our mind, the big picture remains that both revenue and earnings growth remain on a downward trajectory,” Kolanovic said.

Read: Morgan Stanley’s Wilson Says Economy Signaling Weaker Earnings