President Xi Jinping’s government has vowed all year to restore foreign investors’ shattered confidence in China. Since a meeting with US leader Joe Biden steadied ties, Beijing is gradually putting his words into action.

China has unleashed a flurry of market access concessions in the wake of last month’s leaders’ summit. Beijing approved a long-delayed Mastercard Inc. joint venture, then followed up by green lighting one of the world’s largest technology mergers between US chipmaker Broadcom Inc. and cloud company VMWare Inc. Last week, officials announced visa-free access to China for six countries.

Translating “the San Francisco vision into actual policies and concrete steps” is a matter of “first-rate importance,” the official Xinhua News Agency wrote this week. A meeting of the Politburo that Xi chaired on Monday called for “high-level opening up,” a slogan associated with more market access.

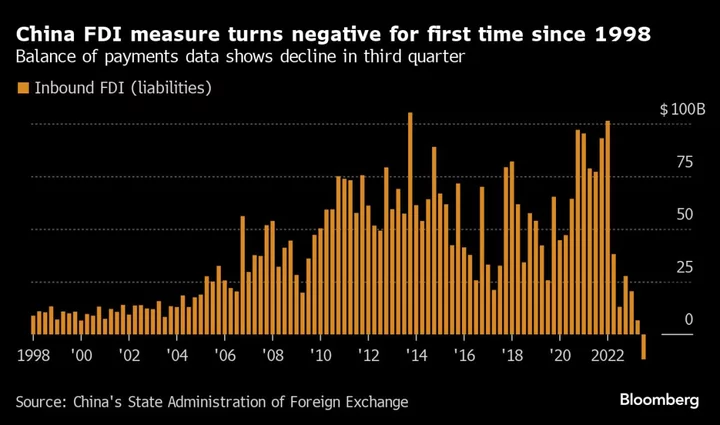

The spate of conciliatory acts since the Biden meeting signals China’s vast bureaucracy, which waits on clear instructions from Xi, is ramping up efforts to stop an exodus in capital. One gauge of foreign direct investment turned negative for the first time since 1998 this year, fueled by tensions with the US and Europe, the nation’s slowing economy and higher interest rates abroad.

Small steps alone are unlikely to answer deeper concerns about policy swings, trade probes and a national security drive that might make it harder to move data overseas. But they could help reassure investors who have been demanding Xi back up his rhetoric on fairer treatment for foreign firms with real policy.

European business leaders now believe Beijing is moving beyond the charm offensive, with a genuine desire to deliver, said one person familiar with recent conversations between executives and China, who asked not to be named discussing private matters. The European Union and China are set to hold a long-delayed summit this month.

Eric Zheng, president of AmCham Shanghai, said in recent months Chinese officials from the central to local governments held listening sessions with senior executives at US firms. “We believe that our feedback has positively impacted some new government measures to support foreign-invested companies in China,” he added.

Watching Washington

China’s already fragile diplomatic ties with the US cratered during the Covid pandemic, and the Communist Party became a greater target for politicians in Washington. Beijing’s close relationship with Russia after its invasion of Ukraine and mounting tensions over Taiwan deepened its rift with Western democracies.

The Europeans “listen” and take cues from Washington, according to Victor Gao, vice president of the Center for China and Globalization think tank who served as translator to the late leader Deng Xiaoping. “The Europeans are really very much influenced by the US perception or misperception of China.”

Xi’s decision to smooth ties with the world’s largest economy at an economic summit in San Francisco — in a warm display that even indicated China will offer more pandas to American zoos — will likely make space for US allies to improve their ties with Beijing.

Already there are signs of improvement. At the beginning of last month, Australia sent its first prime minister to visit Xi in Beijing since 2016, as the two nations buried the hatchet on a $223 billion trade relationship.

China announced Thursday it had begun reviewing its tariffs on Australian wine, with Beijing likely to remove the taxes in the coming months to end years of punitive sanctions.

Last weekend, top Chinese top diplomat Wang Yi restarted in-person trilateral talks with his Japanese and South Korean counterparts after a four-year hiatus during which both nations drifted closer to Washington. Wang called for Seoul — which has yet to embrace US chip curbs on China — to “resist politicization of economic issues and ensure smooth operation of supply chains,” according to a statement.

China’s announcement of a one-year trial of visa-free travel for the European Union’s top five economies — Germany, France, Italy, Spain and the Netherlands — came as Chinese Premier Li Qiang met French Foreign Affairs Minister Catherine Colonna in Beijing.

Beijing has also reached out to UK businesses, with top economic official He Lifeng holding a rare meeting with the chair of the China-Britain Business Council in Beijing this week.

Those overtures won’t only reassure foreign companies, according to Michael Hirson, a China economist at 22V Research LLC, who said that domestic Chinese firms are also sensitive to geopolitical tensions.

“An important motivation for lowering tensions is Beijing’s desire to revive growth and foreign direct investment,” added the former US Treasury attaché in Beijing. “While the more pragmatic tone is positive, foreign businesses have deep concerns that are unlikely to reverse.”

--With assistance from Colum Murphy and Lucille Liu.