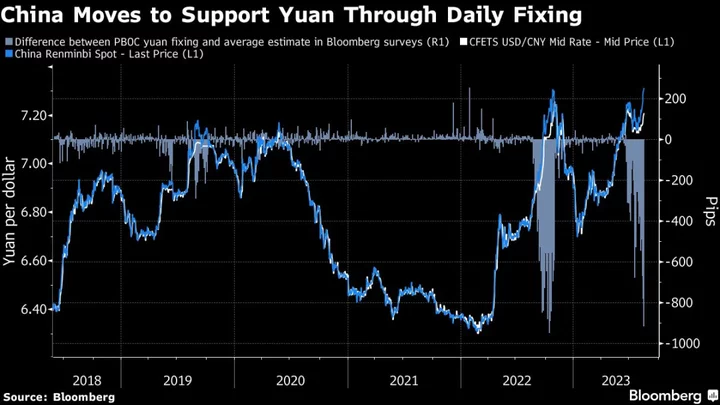

China is close to unleashing its strongest ever guidance to push back yuan bears via its daily reference rate, as the managed currency defies a string of policy signals in a fall toward a 16-year low.

On Friday, the People’s Bank of China has the choice to issue a so-called fixing with the largest ever premium to the average estimate in a Bloomberg survey that started in 2018. That would be a key signal from the central bank that it wants to nudge the currency higher.

Authorities have been escalating their support for the embattled yuan in each and every session over the past week, only to see it sinking in both onshore and overseas markets to multi-year lows. They told state-owned banks to step up intervention, in a push to prevent a surge in volatility, according to people familiar with the matter.

That request came as the yuan fell toward 7.35 per dollar, a level that top leadership has been paying close attention to, the people said. The yuan pared some of the week’s losses and traded around the 7.29 per dollar onshore on Thursday.

The problem for China is that yuan bears have latched on to the fact that the fixing itself has been progressively weaker, regardless of its gap to estimates, and taking that as a sign the PBOC is ok with a slow depreciation in the currency.

That makes Friday’s figure especially interesting for China currency watchers to divine whether or not officials really do have a line in the sand for the under-pressure yuan. A gap of more than 950 pips from the average estimate, would be the strongest on record, in data going back to 2018.

“The PBOC has persisted in setting the fixings much stronger than expected, with the largest counter-cyclical factor since late last year, but they have been allowing the yuan to adjust,” Australia & New Zealand Banking Group strategists including Mahjabeen Zaman wrote in a note Thursday. “This is a sign that the authorities are prioritizing the need to support growth at the expense of the currency.”

China’s currency has tumbled over 5% against the dollar this year amid a disappointing economic recovery and broad dollar strength. PBOC rate cuts to re-ignite growth have just intensified the focus on the widening US-China yield gap and added more pressure to the yuan.

China will resolutely prevent excessive adjustment in the yuan, the PBOC said in its monetary policy report. The foreign-exchange market is currently in line with fundamentals, it said.

The PBOC “will not want the risk of a large depreciation potentially causing financial stability issues,” the ANZ strategists wrote. “We do not foresee a material depreciation in the yuan, and see near-term weakness limited to around 7.40.”