Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a digital marketing director who has a joint income of $246,000 per year and spends some of her money this week on train tickets.

Occupation: Digital Director

Industry: Marketing

Age: 39

Location: Arlington, VA

Salary: $178,500 ($130,000 base and $48,500 in commissions paid quarterly).

My Husband’s Salary: $67,500

Net Worth: $781,800 (home value: $865,000; savings: $90,000; mutual funds: $32,000, IRAs: $91,500, 401(k): $353,800; minus mortgage. Our finances are joint).

Debt: Mortgage: $650,500

My Paycheck Amount (biweekly): $2,615

Pronouns: She/her

Monthly Expenses

Mortgage: $3,604

HOA: $496

Daycare: $1,475

Health Insurance: $275

Dependent Care FSA: $416

Utilities: $125-$200

TV/Internet: $200

Netflix/Audible/Skype to Phone: $40

Car Insurance: $95

Orange Theory/Peloton App: $135

Cell: $55

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, both of my parents grew up in poorer families and still graduated from college and expected me to do so. They both needed to work multiple jobs through college and wanted it to be easier for my siblings and me to attend. My parents saved and paid for about a third of my college expenses. I was in a serious car crash in high school and ended up winning a lawsuit that paid for the rest. I still worked in college during the summer breaks. My husband was not expected to go to college and no one else in his family did. He qualified for financial assistance and did not have to pay tuition. He worked through school to cover room and board.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

Yes, my father worked in the banking industry and frequently talked about saving money, after having grown up in a poor family where his father was in tears trying to cover debts. My parents never discussed budgeting or spending.

What was your first job and why did you get it?

I worked in the kitchen of a restaurant when I was 14. I begged my parents to start working quite young so I would have spending money.

Did you worry about money growing up?

No.

Do you worry about money now?

I do not worry about money now. I have gone through periods of worrying about money. I racked up five figures of credit card debt as a young adult and had to change my lifestyle to pay it off. At that time, I found a bedroom to rent with roommates on Craigslist to cut my monthly housing expenses in half. The second period was at the start of the pandemic when my husband was laid off and collecting unemployment. At that time, our childcare expenses were more than our monthly mortgage and too high to live on only my income. I lost a lot of sleep at night for several months until he was able to start working again.

At what age did you become financially responsible for yourself and do you have a financial safety net?

At age 22. When I graduated from college I was unemployed for several months and my parents no longer supported me financially since I was fortunate to still have some savings remaining from the car crash lawsuit.

Do you or have you ever received passive or inherited income? If yes, please explain.

Yes, we received $30,000 from a family member as a gift two years ago. It is now fully invested in a mutual fund.

Day One

6:15 a.m. — I’m up and so are both of my kids. I start the morning journaling and drinking a cup of coffee with almond milk. Soon, I feel like the morning hours are dragging and I’m not able to focus on anything. I put on my running clothes, hoping to head out later, and take my younger child to daycare as soon as they open at 8 a.m.

8:15 a.m. — I’m back home and read before I take my other child to the bus stop. After the bus comes, I head out for a short run to put myself in a good headspace before starting work.

9 a.m. — I start working at home and need to focus on a client project that requires a lot of attention. I grab a pre-made green smoothie from the fridge for breakfast. I eat the same thing almost every day for breakfast and usually make the smoothies ahead of time. I use protein powder, unsweetened vanilla almond milk, chia seeds, flax meal, PB2 powdered peanut butter, frozen bananas, avocado and spinach.

12 p.m. — I’m a little stressed but on a roll to finish the assignment in the next hour. I grab a peanut butter and jelly sandwich and a bag of my kids’ veggie straws. I’m in a groove and work on the project between meetings, finishing it at 1 p.m.

1:15 p.m. — I take a quick shower and am glad to finally wash my face for the day. My skincare in the morning (afternoon today) includes washing my face in the shower, daily sunscreen and vitamin C serum before I do light makeup with CC cream. I go for a 15-minute walk outside before heading back into calls.

4 p.m. — My last call of the day ends early so I take an online exam that is required for a professional certification. It takes more than an hour but I get a higher score than expected!

5:45 p.m. — I wrap up work and then look at flights for a trip I have planned with my sister this summer. Prices are reasonable and I decide to book. I have over $200 in points and only pay $84.90 for direct, round-trip airfare. $84.90

6:15 p.m. — I eat dinner with my family: a turkey meatloaf I made and froze a few weeks ago, leftover mac and cheese, and a spinach and kale salad. After dinner, I pack a lunch and my work bag to take into the office the next day.

7:30 p.m. — I head out to meet friends at a nearby wine bar. It’s a 10-minute walk and we’re supposed to meet now so I text and find out they are running late too. Once I get there, the bartender mixes up my friend’s wine before I order so I offer to take it. He doesn’t charge me for it. I order a second glass before we end for $15.20, including tip. I wrap up the evening early to hang out with my husband when I get home. $15.20

9:15 p.m. — I walk home and spend some time with my husband before falling asleep a little after 10 p.m. I always wash my face and add moisturizer before bed. I try to add witch hazel toner after the wash and hyaluronic acid and retinol serums before the moisturizer but those only happen a couple of times a week.

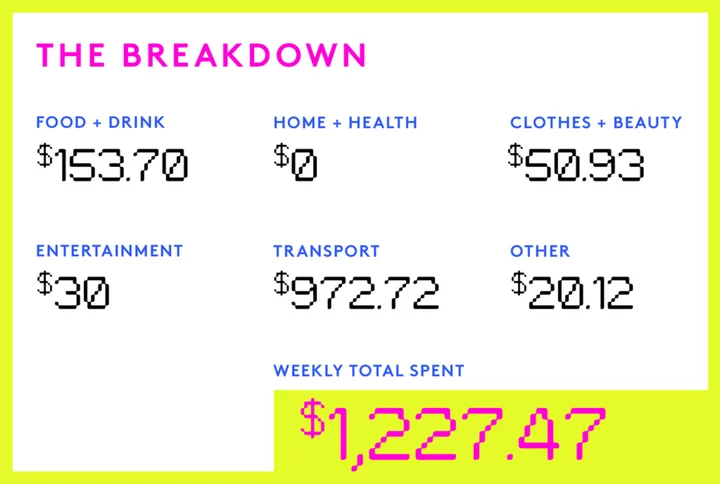

Daily Total: $100.10

Day Two

4:15 a.m. — My alarm goes off for an early gym class with a friend. I don’t have enough energy so I text her and tell her I’m sleeping more. We usually go once a week together at 5 a.m. and the class is twice as fun when she’s there. I don’t enjoy the early wake-up but it is usually worth it to join her. I get up two hours later and have coffee and change into my running clothes. I end up helping my kids get ready for school.

7 a.m. — I head out for a 30-minute run and then get ready for work once I’m finished. I use Apple Pay to load $10 on my Metro card for my commute. $10

8:15 a.m. — I leave home and respond to emails while I walk to the train station and then read on the ride. I arrive at 9 a.m. to my office in D.C. for a busy morning, with several things that have already come in today needing attention. I’ve brought a pre-made smoothie and enjoy it with a second cup of coffee as I start my workday. My office has good coffee, which is a small perk for the commute.

12 p.m. — I need a break from an overloaded morning at work and look at my texts and then head to a nearby art museum with free entry to check out two exhibits. I swing by the White House since I’m a block away and watch the tourists for a short while. There are always protests happening, which makes for good people-watching. I head back to my office and have the salad I packed for lunch. I included leftover grilled chicken, kale, spinach, carrots, pepper, dried cherries and pumpkin seeds. I eat then plug back into everything else that needs to be done this afternoon at work.

4 p.m. — I wrap up my work items for today and order Yankees hats for both of my kids for an upcoming home game that we scored free tickets for. New caps are expensive so I look at Poshmark and find two hats for $50.93. Not a deal but less money than buying new. $50.93

5:30 p.m. — I respond to several questions from my team and go through my email, then decide to call it a day and head home.

6:15 p.m. — I arrive home and discover everyone has already eaten but forgot to make enough for me. I heat up a piece of leftover meatloaf and have an apple with peanut butter. We talk about our days before my husband leaves for the kids’ soccer practice. I grab a chocolate-covered banana, watch TV, then do laundry and a few household tasks.

8:15 p.m. — I leave for a run to Trader Joe’s and spend $31.52 on riced hearts of palm, biscotti, a protein bar and more chocolate-covered frozen bananas. $31.52

8:30 p.m. — I stop to get gas on the way home and fill up for $40.82. Gas seems expensive but I don’t drive often and only fill up about once a month. My car is 15 years old and has been paid off for a long time. We probably only need one vehicle but own two parking spaces and keep it for convenience. $40.82

8:35 p.m. — I arrive home and once the kids are in bed, my husband and I spend a little time on financial planning because I received a quarterly bonus this week. We look at our balances, the bonus I just received and upcoming expenses. My tendency is to immediately spend or invest any money saved above our emergency savings. My husband prefers to keep saving without a specific goal. While these two styles clash, both can be helpful. While I am the higher earner now, he made 40% more than I did when we first combined finances and fully paid for the down payment on our condo when we were first together. This history makes us feel like equal partners even though there is a larger variance in our incomes now. We both contribute toward our Roth IRAs; I choose to add $4,000 and he transfers $3,000.

9:30 p.m. — We watch Ted Lasso and then head to bed at 10:45 p.m. This is by far our favorite show to watch together.

Daily Total: $133.27

Day Three

5:45 a.m. — My alarm goes off early so I can go to the gym. I drink a cup of coffee while I get ready. I leave at 6 a.m. I prefer the “later” time when I’m not meeting up with my friend.

7:30 a.m. — I arrive home and don’t need to get ready to start work for a bit. My husband and I look at transportation options to New York for our upcoming holiday weekend trip. We’ve already reviewed pricing for the bus, train and flights and concluded there are no good options with convenient timing or decent cost. He is in favor of taking the train (the most expensive option). I vote for taking the bus (the cheapest option) as our kids have traveled on longer bus rides before. Neither of us wants to fly since there is a higher risk of cancelation. We can save about $300 taking the bus but I don’t feel strongly so he books train tickets for $828. We both think this is expensive and note prices have increased recently, likely because it is a holiday weekend and more people know it is better than flying. $828

8 a.m. — I get ready and drink a pre-made green smoothie while I blowdry my hair and watch Netflix. After I get ready, I head to a coffee shop to start working. I buy a small drip coffee and tip 50% since it is so cheap and I really am just looking for free wi-fi. After working on several client questions, I look at job sites quickly to see if it’s worth applying anywhere as I’m considering switching roles. I see one that is a good fit so I save it and make a note to apply when I have more time this weekend. $3

10:45 a.m. — I text an old coworker and make plans to meet up for lunch next week. We haven’t worked together for a few years and try to get together when we’re both in the city. I head home for my first call of the day. I stop by a local toy store and purchase a birthday gift for one of my kid’s friends. $20.12

11 a.m. — I arrive home and realize my call isn’t scheduled for another 30 minutes. I hang a canvas I ordered last week using a photo I had taken. My favorite “art” is using my own photographs of local sites or from traveling and I have a few of them now. Then I’m back in my home office for the call. It ends early and I decide to attempt getting free timed museum tickets released at noon each day. I score tickets then journal. Then I head back into calls for work for the next hour and a half.

2 p.m. — After my meetings have wrapped for the day, I grab lunch with my husband at home (leftover meatloaf and salads with the same toppings I took to the office yesterday). After a half-hour, I get back to work to tie up loose ends for the day. I text with a few friends, laughing about things that have happened at work.

4:30 p.m. — I leave to go pick my child up from daycare. It is raining so I end up driving. The weather is making me feel done for the week. I respond to a couple of final messages and emails for work. My husband needs to work late this evening so I am solo parenting. I finish work after another hour and serve the kids a charcuterie-like platter I prepped last night. I included salami, cheese, crackers, cucumbers, hummus, carrots, bell pepper and berries. They help themselves and I scroll and then read for a decent chunk of time.

7 p.m. — I make the kids popcorn while they watch a movie and then foam roll for 30 minutes. My muscles feel extra tight because I’ve recently started running more to train for a short race.

9 p.m. — My kids go to bed and then my mom calls. I haven’t talked to her for two weeks because she’s been on vacation. It is great to catch up and we end up chatting for an hour and a half. At the end of our call, I realize a podcast I love has moved to a new platform and I add a new subscription to continue supporting the hosts. I’m in bed by 11 p.m. $30

Daily Total: $881.12

Day Four

6:30 a.m. — It is still raining so I’m up early to see if my kids’ sports are canceled. I hear the kids up a half-hour later and make coffee. We are supposed to be at the ball field by 8 a.m. and I’m dreading the very early weekend game. The games still aren’t called off and we need to start getting ready to make it on time. I text a friend with a kid on the team and she agrees it will be rained out. I drink my coffee until the game is officially canceled. I’m glad I looked ahead yesterday and reserved the museum tickets for this morning.

7:15 a.m. — I journal and try to start the day with gratitude. It is a helpful habit I’ve kept up. Then I make green smoothies. I make three so I can have them ready for the next few days.

8 a.m. — I get ready for the art museum and feed the kids breakfast, including pancakes, yogurt and apples. They also ask for a piece of avocado toast. I eat one of the pancakes with almond butter and then half of a smoothie. We leave for the museum about an hour later and I add $9 total between our three accounts for the train. I read a novel for most of the ride. $9

10 a.m. — We arrive at the museum as it’s opening and ahead of our ticketed time. After a couple of hours at the interactive art exhibits, my kids want something to drink and a cup of coffee sounds nice. The line at the coffee bar inside the museum is long so we go to the courtyard outside and find they have free Starbucks coffee and drinks for a sponsored public event. There’s no line so I grab a cup and something for the kids.

12:15 p.m. — We leave the museum to head back home. I enjoy more time to read while we’re on the train. When we arrive home 45 minutes later, my husband has cooked salmon and broccoli for us.

2 p.m. — After cleaning up from lunch, I work on a creative photography project for a bit and then take a nap.

3 p.m. — I wake up and our power is out. It is not common here but I can see a power line down outside our building. We have plans later to go to an outdoor brewery with friends. It’s very wet so I text to rain check and they invite us over for dinner. I offer to bring a salad and dessert and need to run to the grocery. Thankfully the electricity is on nearby so I buy beer, kombucha, salad ingredients, mini ice cream cones, ground beef, sausage, mozzarella, ricotta and carrots. $91

5:15 p.m. — We drive to our friends’ place and hang out since they have electricity. The adults play The Ultimate Game for Couples, which is really fun while the kids play in another room.

6:45 p.m. — We all sit down for dinner. After dinner, the adults hang out more while the kids watch a movie and eat ice cream cones. We play a little more of the game, catch up and mostly laugh and share funny stories. We head home at 10 p.m. and the kids go to bed soon after.

11 p.m. — Our power comes back on (finally!) and I spend time with my husband until we go to bed at 11:30 p.m.

Daily Total: $100

Day Five

7 a.m. — I wake up early to go for a run. I finish my coffee first (always) and then make the kids breakfast (leftover pancakes from yesterday I’ve frozen and pop in the toaster, plus raspberries and blackberries). Then I head out for my run.

8:35 a.m. — I return from running, take a shower and get ready while I drink one of my green smoothies. My family typically goes to church and about an hour later my husband leaves with our youngest child and I take our older one to a birthday party.

12 p.m. — The party is over and our outdoor plans are canceled this afternoon (because of rain again). I text a friend who just had a baby to see if I can stop by this afternoon. I’ve had hearts of palm lasagna “noodles” on hand to try for months so I make one for lunch using the other ingredients I picked up yesterday. We have salad ingredients on hand to go with it. I make a double batch so I have a lasagna to take to my friend with the new baby.

2 p.m. — I take my younger child to his friend’s house. Once I’m back home, I prepare the carrots and leftover parsnips to cook with the corned beef I have in the freezer, thinking this will make an easy dinner tomorrow.

2:45 p.m. — I apply for the job I had seen when I looked earlier in the week. It is pretty similar to what I do now so it is easy to tweak my resume for the position. Since it is like my current position, I also question if it is different enough to make a change.

3:30 p.m. — I go see my friend with the baby, drop off the extra lasagna and then pick up my child and his friend to go home. Once I’m back, the kids play and I put away laundry and pick up our place for a while. I realize I should think about dinner, even though I’ve cooked a lot today. I usually make a lot of food on the weekends and then do not cook as much during the workweek. I’m not against eating out but it adds up quickly. My first year out of college, I amassed $10,000 in credit card debt and realized that eating at home was a good way to save. I have ingredients for the kids to make their own pizzas. I add seasoning and caesar dressing to chicken for myself and cook it on the stove. I put the pizzas in the oven for an early dinner. I have a ton of raw vegetables and fruit on hand so I let everyone grab what they want, family style. I choose bell peppers and hummus with my chicken.

6:45 p.m. — My friend comes over to pick up her child. I clean up the kitchen and tell the kids to start getting ready for bed early. Once they finish, I let them play video games while I watch Netflix.

8:15 p.m. — I encourage my kids to go to bed and start reading. After a half-hour, I go back to watching Netflix.

10:15 p.m. — Go to bed.

Daily Total: $0

Day Six

6 a.m. — I wake up early. I grab coffee, meditate and read. I use Headspace on a free family plan through a sibling’s corporate benefits program. I try to use it a few times a week and have been doing so since 2020. I also aim to read for at least 20 minutes a day. It is something I love (even more than sleeping) and a great way to quietly start my day when I can.

6:30 a.m. — My kids are up so I fix them avocado toast, fruit and yogurt for breakfast.

7 a.m. — I head out for a short run. I have mostly been inside for three days and the weather gives me energy, along with endorphins from the exercise. When I finish, I grab breakfast (pre-made green smoothie again) and hop in the shower to get ready for the workday.

8:25 a.m. — After I help get the kids ready and remind them to brush their teeth, we walk to the bus stop. Then I walk with my younger child to daycare.

9 a.m. — I’m back home and need to start working straightaway. After a couple of hours of working, I add the corned beef to the slow cooker along with vegetables I peeled and chopped yesterday.

12:30 p.m. — I take a break and make a salad and use the leftover salmon my husband fixed over the weekend. Then I take my short walk outside. After a 45-minute break, I go into afternoon meetings and keep busy working until 5:45 p.m. It makes the afternoon go quickly.

6 p.m. — My husband arrives home from picking the kids up from school and daycare. They’ve been to the library and are excited about borrowing several books. The kids are playing upstairs so I enjoy catching up with my husband and reading.

6:55 p.m. — After we eat the corned beef, carrots and parsnips for dinner, I clean up while my husband facilitates getting the kids ready for bed. Once they’re done, one of my kids asks to play Monopoly so I agree to start a game.

7:30 p.m. — I take my younger child upstairs to read some of the new library books to him before bed. He falls asleep before we even start.

7:45 p.m. — I scroll social and wait for my other child to go to bed. He’s done for the night about 30 minutes later so I spend time with my husband. We haven’t watched Bad Sisters and try the first episode since several people have recommended it. It is funny.

9:45 p.m. — I go to bed early so I can head to the gym in the morning.

Daily Total: $0

Day Seven

5 a.m. — I didn’t sleep well last night (dreaming about work, ugh) so I decide to get up early. I have a cup of coffee, meditate and read. This is not as good as a great night of sleep but it is still a nice way to start the day.

5:45 a.m. — I change into my workout clothes and head to the gym to take a class. I’m feeling energized for the day ahead.

7:30 a.m. — I get home and finish helping my kids get ready for school and pack our bags. Then I take a shower and get ready for the office.

8 a.m. — We leave to drop my child off at preschool and then I walk to the train. I check my email while waiting for the train and then read during my ride. I arrive at the office and start working about an hour after leaving home. I’ve packed a smoothie for breakfast and have another cup of coffee.

12 p.m. — I meet up with my former colleague for lunch. I order a salad bowl with greens, lentils, chicken, brussels, hummus, tzatziki, pickled onions and olives for $12.98. We have a great time catching up. $12.98

1:05 p.m. — Back to work and prep for a meeting with my team. The afternoon is busy with work so it goes by quickly. I wrap up at 5:30 p.m. and head home for the day.

6:15 p.m. — I arrive home and my husband has made a dinner of leftover chicken, fries and green beans. I help clean up the kitchen and then start prepping for tomorrow, packing snacks for my kids and backpacks.

7:45 p.m. — I am almost to the end of my book so I head to my bedroom and finish reading Summer of ’69.

8 p.m. — I shower and wash my hair. I hate blowdrying my hair so I always watch Netflix or listen to a podcast to add some enjoyment.

9:15 p.m. — Watch Netflix with my husband and multitask by catching up on folding laundry. After 45 minutes I head to bed so I can get up for a workout in the morning.

Daily Total: $12.98

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.