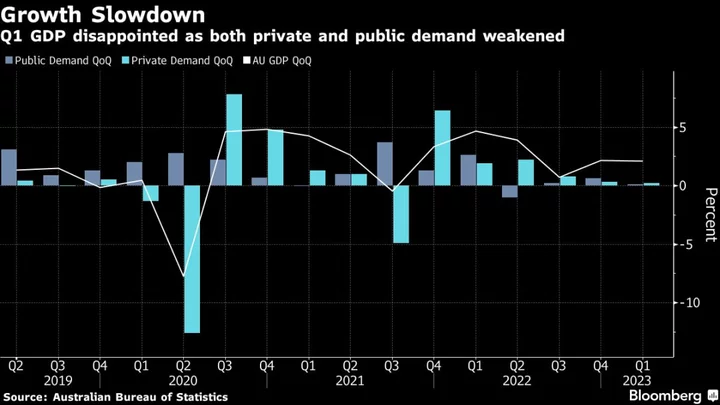

Australia’s economy slowed in the first three months of the year as the Reserve Bank’s aggressive policy tightening weighed on household spending and construction, while accelerating labor costs underlined the nation’s inflation challenge.

Gross domestic product advanced 0.2% from three months earlier, coming in below economists’ estimates for a 0.3% gain, Australian Bureau of Statistics data showed Wednesday. From a year earlier, the economy grew 2.3%, slowing from a downwardly revised 2.6%.

The weakest quarterly expansion since the third quarter of 2021 sent the currency down a tad.

The result is unlikely to surprise policy makers who are predicting a substantial economic slowdown over the coming year driven by 12 rate increases since May 2022, with the latest coming just a day ago.

The report showed Australians again tapped cash built up during the pandemic to finance consumption as the savings ratio dropped. Household spending advanced just 0.2% in the first quarter, adding 0.1 percentage point to growth.

“Spending on essential goods and services were the main contributors to the rise in household spending, while discretionary categories such as furnishing and household equipment, purchase of vehicles and other goods and services all detracted from growth,” Katherine Keenan, ABS head of National Accounts, said in a statement.

Labor costs accelerated to 2.4% in the first three months of the year, driven by the public sector and higher than usual end of year bonuses.

Australia’s Persistent Inflation Tests RBA’s Patience, Lowe Says

The GDP data follow back-to-back unexpected RBA hikes that took the cash rate to 4.1%, its highest level since April 2012, threatening the central bank’s goal of a soft landing. Economists see a better than 1-in-3 chance of an Australian recession over the next 12 months as higher borrowing costs begin to crimp domestic consumption.

Central banks worldwide have been rapidly tightening policy in response to stubbornly strong inflation, even at the expense of slower growth and higher unemployment. The Federal Reserve is under pressure to keep raising rates as US consumer prices remain elevated, although it may skip at the June meeting.

For Australia’s center-left government, the GDP data mean it has to navigate rising consumer prices, higher borrowing costs and slower growth as it enters a second year in office.

To date, the nation has benefited from elevated export prices that have brought a windfall to the fiscal coffers, including returning the budget to surplus for the first time in 15 years.

Today’s GDP report also showed:

- Dwelling investment fell 1.2%, cutting 0.1 percentage point from GDP

- Machinery and equipment investment surged 6%, adding 0.2 point

- The household savings ratio fell further to 3.7% from 4.4%

--With assistance from Tomoko Sato.

(Adds further details.)