China’s indebted local governments are using a controversial way to generate revenue as they struggle to pay bills: imposing egregious levies on their public.

A Shanghai restaurateur was fined 5,000 yuan ($702) this month for serving shredded cucumber without a licence, prompting outrage on China’s Twitter-like Weibo. In a post viewed 9.5 million times, one user wrote: “If they wanna fine you, even adding vinegar could be wrong.”

Truckers in central Henan province last month made headlines when they questioned the accuracy of government vehicle weighing machines, after being repeatedly fined for exceeding limits: one driver had received tickets totaling $38,000 in the past two years.

In Guangxi, one of China’s most indebted provinces, a state-backed company sparked anger in May for hiking parking fees, leading some commuters to rack up thousands of yuan in charges. After Weibo users questioned their legitimacy, the Nanning city mayor bowed and apologized at a press conference.

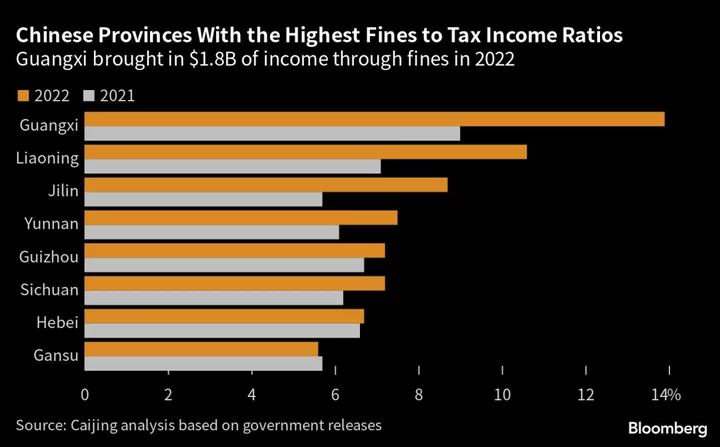

These high-profile scandals represent a broader trend: Guangxi alone made 13 billion yuan from fines last year, according to an analysis of government data by Caijing Industry Research Center. That’s equivalent to about 14% of its tax income, rising from 9% in 2021.

Thirteen of the 22 provinces and municipalities that published detailed official fiscal income data saw a bump in their fees to tax income ratio last year, although it was likely also bolstered by unprecedented rebates.

China’s local governments have suffered the dual blows of the pandemic and a property crackdown from Beijing in recent years, leaving them with too little income to spend on salaries and building roads, while at the same time paying their debt bills. Goldman Sachs Group Inc. estimates China’s total government debt is about $23 trillion, a figure that includes the hidden borrowing of thousands of financing companies set up by provinces and cities.

The central government reiterated this month that provinces have to fix hidden debt problems on their own, prompting local officials to get more creative to raise revenue for their day-to-day spending.

“It is a sign of desperation,” said Victor Shih, an associate professor at the University of California, San Diego, who specializes in China’s banking policies. “Arbitrary fines and predatory behavior will drive businesses away, especially small and medium businesses without the political protection of large state-owned enterprises,” he added.

READ MORE: China’s $23 Trillion Local Debt Mess Is About to Get Worse

Government scrutiny of egregious levies has ramped up over the past six months, after a string of high-profile cases. Last year, a grocer in Shaanxi province was fined 66,000 yuan for selling 2.5 kilograms (5.5 pounds) of substandard celery, while in August, officials in Guangdong were found to have falsified evidence to fine trucks for suspected illegal dumping.

In February, then-Premier Li Keqiang called on provinces to “resolutely put an end to arbitrary fees” and fines at a cabinet meeting. Following the Guangxi street-parking uproar, city authorities in Jiangsu, Inner Mongolia, Zhejiang, and Shandong also started cracking down on expensive parking fees.

The levies are unlikely to make a meaningful difference to the shortfall in local finances. Still, excessive fines will probably remain a feature as provinces are left to shoulder their own problems, said Zerlina Zeng, senior credit analyst at CreditSights Singapore LLC.

“As fines and other regulatory burdens kill off the SMEs, local governments would further lose tax income, become even more reliant on fines, and dependent on transfers from central and other upper-tier governments,” Zeng said.

She added: “This could be detrimental to the local business environment and result in a vicious cycle in weak regions.”

--With assistance from Fran Wang, Yujing Liu, Yihui Xie and Colum Murphy.