Marcolin SpA, an eyewear maker for brands including Tom Ford, is considering a sale, people with knowledge of the matter said.

The PAI Partners-backed company is working with Goldman Sachs Group Inc. to gauge potential interest and is targeting a sale to a strategic buyer, according to the people. A deal could value Italy-based Marcolin at €1.35 billion ($1.43 billion), one of the people said.

Deliberations are ongoing and there’s no certainty they’ll result in a sale, the people said, asking not to be identified discussing confidential information. A representative for PAI declined to comment. A spokesperson for Goldman Sachs didn’t immediately comment.

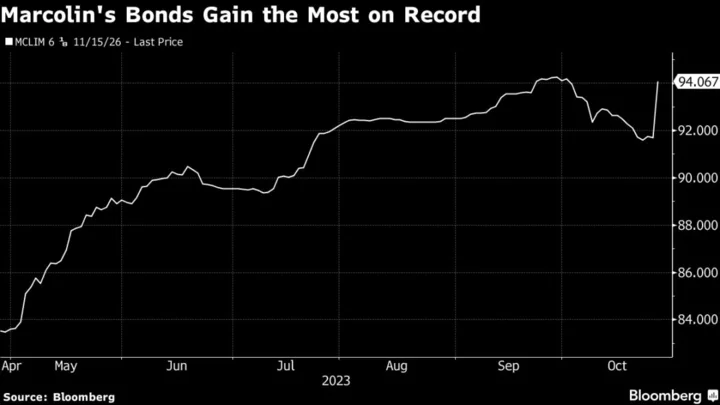

Marcolin’s bonds due 2026 rose by a record 2.4 cents on the euro on Thursday to around 94 cents, according to data compiled by Bloomberg.

Founded in 1961, Marcolin saw revenue rise 20% to €548 million last year, according to a company presentation. PAI agreed to buy a majority stake in the business in 2012.

Last year, Marcolin teamed up with Estee Lauder Co. in the $2.8 billion acquisition of luxury brand Tom Ford. It funded $250 million of the deal for a “substantial” extension of the licensing agreement, according to a statement at the time. Marcolin is also a license partner for Adidas AG, Max Mara and Ermenegildo Zegna NV.

--With assistance from Luca Casiraghi.

(Updates with bond prices in fourth paragraph and chart.)

Author: Swetha Gopinath, Ruth David and Crystal Tse