Peloton Interactive Inc. rose Monday after long-standing bear Simeon Siegel at BMO Capital upgraded the exercise equipment company to market perform, saying the shares better reflect concerns such as subscriber growth.

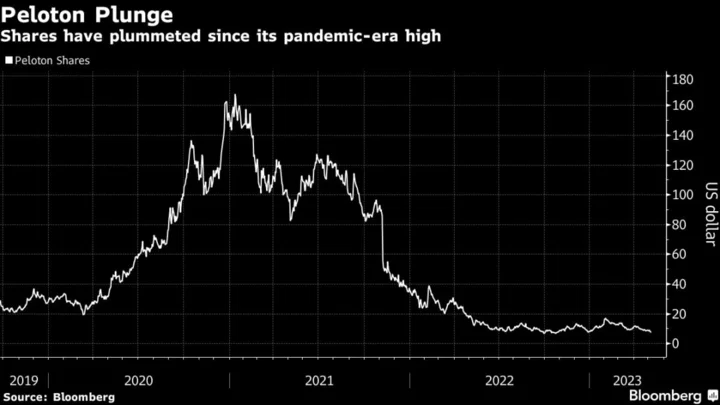

The stock climbed as much as 6.5% to $8.32 after the analyst lifted it from underperform and maintained his $9.50 price target. Peloton — known for its exercise bikes and remote classes — has plunged more than 90% from a January 2021 pandemic closing high, as it struggled to adjust to the economy’s reopening and dealt with equipment issues and a streaming dispute.

For Siegel, the bottom line is that “after all this time, the risk/reward has shifted, even seeing a likely upward skew at current levels,” he said in a note Monday.

“Our underperform rating the past few years was predicated on a mismatch between narratives and numbers; storytelling lifted shares as total-addressable market (TAM) tales painted a future more exciting than customer counts ever supported,” the analyst said.

“We still fear TAM will prove materially lower than management expectations and see risks (hence not outperform), but also see green-shoots,” he said.

The upgrade follows Peloton’s May 4 earnings report, which triggered the steepest decline in seven months for the company. The firm said the current quarter would be “among our most challenging” in terms of growth and as a patent settlement will weigh on cash flow.

Peloton Falls on ‘Challenging’ Growth Outlook, Dish Settlement

Siegel was the first Wall Street analyst to downgrade Peloton to a sell-equivalent rating in April 2020 on concern that the pandemic lockdown was pulling demand for its bikes forward, rather than signaling an expansion of potential users. He said he saw downside until the company could prove a path to profitability.

Siegel’s call wasn’t popular at the time, but ended up being proven right. Shares of Peloton skyrocketed during the pandemic, surging 477% from its 2019 initial public offering price of $29 to an all-time high close above $167 in January 2021.

Wall Street is largely neutral on shares of Peloton. The company has 12 buy ratings, 17 holds and 3 sells, according to data compiled by Bloomberg. Siegel’s price target is below the $11.74 average, but still implies 22% upside from Friday’s close.