Thailand must bolster its revenue collection in the long term to meet growing public spending needs stemming from an aging population, according to the World Bank.

Government expenditure on pensions, healthcare, education and climate adaptation will need to increase and this must be achieved without constraining economic growth and keeping public debt under control, the bank said in a report on Thailand’s public revenue and spending assessment on Monday.

“Thailand can achieve a more equitable and resilient economy by improving the efficiency of public spending, raising revenues, and implementing policies to support the most vulnerable and respond to climate-related challenges,” Fabrizio Zarcone, World Bank’s Country Manager for Thailand, said in a statement.

The bank recommends a series of progressive tax reforms that could collectively increase revenues by 3.5 percentage points of gross domestic product for Southeast Asia’s second-largest economy. These include raising value-added tax rate and removing exemptions, broadening the personal income tax base and streamlining allowances and deductions, and expanding property tax collection.

“If implemented gradually over the rest of this decade, these reforms would promote equity while providing the revenue needed to fund increased spending,” World Bank said. “Negative impacts on the poor could be offset by social assistance reforms, while still achieving substantial net revenue gains.”

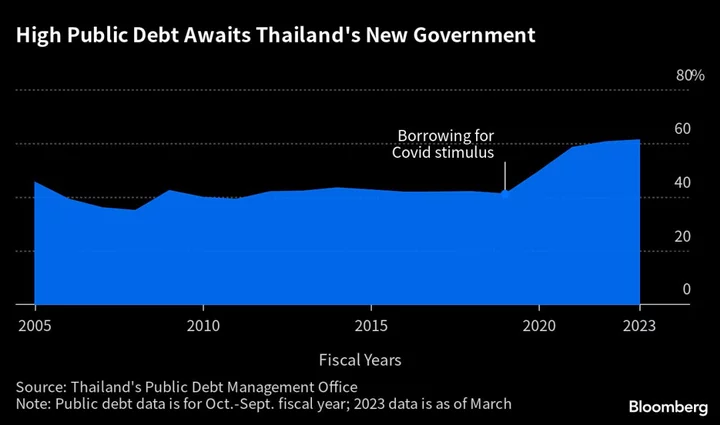

Thailand’s public debt has risen to more than 60% from about 40% before the pandemic after the nation ramped up borrowing to tackle Covid outbreak and fund stimulus measures. State debt may further balloon as a coalition of pro-democracy parties, which won the May 14 election on a litany of freebies and cash handouts, may need to borrow more to fund their promises.

While the public debt has risen due to the pandemic response, overall fiscal risks remain manageable, the World Bank said, adding in the near-term the government can afford to increase spending on public infrastructure and other priority areas by consolidating spending elsewhere.