It’s not every day that Cathie Wood labels a stock-market darling of the innovation economy too expensive.

But Nvidia Corp.’s outsized jump has prompted an unusually skeptical response from the manager of the ARK Innovation ETF (ticker ARKK). Wood said in a tweet on Monday that the world’s most valuable chipmaker is “priced ahead of the curve.” This comes after she closed out her Nvidia position in the ARKK fund in early January before the stock more than doubled to the cusp of a $1 trillion market capitalization.

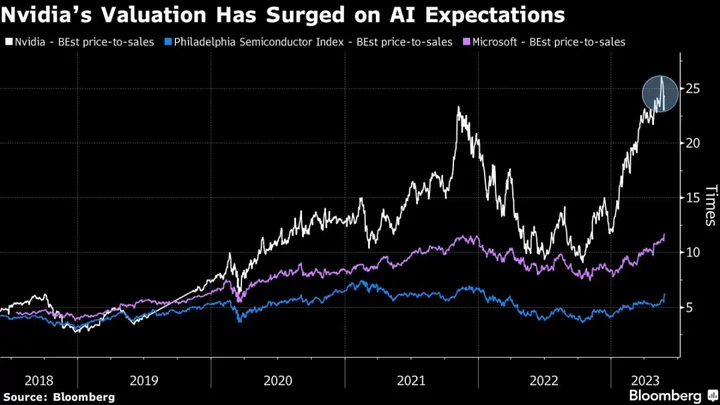

The number that made Wood’s eyes pop is the 25 times sales for the current financial year at which Nvidia is trading amid investor enthusiasm for all things artificial intelligence. That compares with about six times for its peers on the Philadelphia Semiconductor Index and about 12 times for ChatGPT backer Microsoft Corp.

Cathie Wood’s ARKK Dumped Nvidia Stock Before $560 Billion Surge

True, Nvidia has traded at a premium since the pandemic but the gap is looking more pronounced amid the recent hype. And beyond AI, some analysts say the outlook for chips is still dismal amid tepid demand for consumer electronics more traditional servers.

“Recent results at Nvidia have heightened expectations for AI servers,” SMBC Nikko Securities Inc. analysts including Takeru Hanaya wrote in a note. Still, there is a “contrast between AI expectations and overall market weakness,” demonstrated by ongoing price cuts and inventory adjustments in the chip industry.

Nvidia was co-founded in 1993 by Jensen Huang, who still runs the company. It proved more successful than its peers at developing chips that turn computer code into the realistic images that computer gamers love, and rode out a wave of consolidation that saw its rivals acquired, bankrupted or merged into larger companies.

Huang unveiled a series of new AI products on Monday at the Computex trade show in Taiwan. The wide-ranging lineup included a new robotics design, gaming capabilities, advertising services and a networking technology. Perhaps most central to his ambitions, Huang took the wraps off an AI supercomputer platform called DGX GH200 that will help tech companies create successors to ChatGPT.

The question is, how much are the shares pricing in that potential at the current level. Or overpricing it.

“We basically feel that Nvidia’s stock is in bubble territory, regardless of the future potential growth,” independent analyst William Keating wrote in a note on Smartkarma over the weekend. “In other words, we think the train has left the station and we see little point in chasing it down the tunnel at this stage.”