The biggest debate for sell-side analysts covering Chinese equities these days centers around a $31 billion question: what is the outlook for XPeng Inc. The divide is sending shares on quite a roller-coaster ride.

The Chinese electric-vehicle maker has one of the widest price target gaps among members of the MSCI China Index, according to Bloomberg-compiled data, with analysts forecasting the stock could surge to HK$196 — or slump to HK$18 — over the next 12 months. That’s a gain of 169% or decline of 75% as of the stock’s Friday close. Between June and July, the shares surged nearly 180% before falling 30% over the next three weeks.

The stock is likely to face further swings after the European Union’s move to fight back against Chinese EV imports through potential tariffs. While that hurt shares in the sector briefly, the carmaker faces even bigger problems back at home.

Price cuts across the industry this year have hurt margins while analysts have become wary over the benefits of Volkswagen AG’s recent plans to invest $700 million into XPeng. That’s led to a gap of some $31 billion in market value in Hong Kong between the two price target extremes for the company, highlighting the uncertainty amid a slowing economy.

“There is some split in the market over XPeng’s outlook given the fierce price wars in China. That disagreement widened after XPeng’s recent partnership with VW,” according to Steven Leung, executive director at UOB Kay Hian Hong Kong Ltd. “It’s challenging to value the automaker properly.”

The uncertainty is part of the reason why the Guangzhou-based company is now the third-most volatile Chinese stock, just after debt-laden Country Garden Holdings Co. and its services arm, according to Bloomberg data.

For bulls, analysts say the company’s efforts toward developing autonomous driving software and its recent deal to team up with Volkswagen AG is helping boost faith in future performance. An upgrade last month by HSBC Holdings Plc should boost prospects.

“Considering the leading edge in smart driving and revenue contribution from software business, we think XPeng should enjoy a higher valuation multiple that’s comparable to Tesla,” Soochow Securities Co. analysts including Xili Huang wrote in a note earlier this month. Huang has the highest target price on the street.

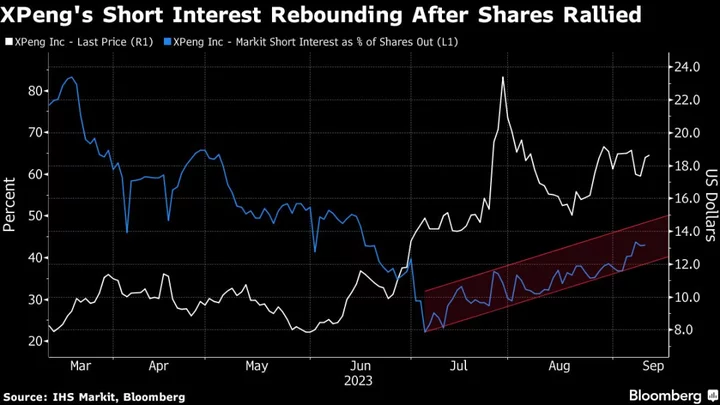

There are some reasons for caution, though. Short-selling activity for the stock is piling up after a pullback in early July. Short-interest accounts for about 43% of outstanding American Depositary Receipts in the US, according to IHS Markit data.

Investors may also remain cautious on XPeng as the company is known for selling lower-priced models at the expense of its profits. According to UOB, XPeng should remain loss making through 2025 given its negative gross margin and further pricing pressure on its models.

For now, investors say the company’s fortunes and fate will be dependent on a number of key measures, including margins and production outlook. Those fundamentals may be the best way to determine where shares head.

“Until XPeng overcomes its production bottlenecks and improves its operating margins, my target for the stock will be in the lower range than a very optimistic one,” said Andy Wong, fund manager at LW Asset Management Advisors Ltd.

Top Tech Stories

- KKR & Co. agreed to pay S$1.1 billion ($807 million) for a fifth of Singapore Telecommunications Ltd.’s regional datacenter business, making its latest bet on Asian digital infrastructure.

- Delivery times for the just-unveiled iPhone 15 Pro quickly slipped until November for some configurations, suggesting that demand is strong for the high-end versions of Apple Inc.’s new lineup.

- Klaviyo Inc., a marketing and data automation provider, is elevating its target to $557 million for what is expected to be a third major US initial public offering in a week, according to people familiar with the matter.

- Tesla Inc. is expected to double its orders to TSMC to 10,000 units next year for its Dojo supercomputer, with more orders in 2025, Taipei-based Economic Daily News reports, without saying where it got the information from.

- Apple Inc. partner Foxconn Technology Group plans to double its investment and employment in India, highlighting an accelerating manufacturing shift away from China as Washington-Beijing tensions grow.

Earnings Due Monday

- No major earnings expected